Who Made the New Deal?

Part I: What Caused the Great Depression?

In the midst of one of our country’s worst economic crises, a new president is elected because he promises hope and change. The outgoing president is despised as a shill for the wealthy. The incoming president has promised to clean up the economic mess: high unemployment, industry crippled by overproduction, vast inequalities of wealth that have resulted in a dangerous debt bubble, and a financial meltdown bankrupting some of the biggest banks. This was the United States in both 1932 and 2008. The similarities between Franklin Delano Roosevelt’s campaign promise of a “New Deal” and Barack Obama’s “change you can believe in” are too much for an astute observer of history and politics to ignore.

There certainly was no shortage of comparisons between the two in 2008. Time magazine’s November cover story, “The New New Deal,” featured a picture of Obama superimposed over a photograph of FDR. The New York Times ran liberal economist Paul Krugman’s op-ed “Franklin Delano Obama?”

Yet, less than a year later, some commentators began comparing Obama to another Depression-era president. “Much like Herbert Hoover,” Kevin Baker wrote in a July 2009 article for Harper’s, “Barack Obama is a man attempting to realize a stirring new vision of his society without cutting himself free from the dogmas of the past—without accepting the inevitable conflict.” Indeed, as we near the end of his presidency, it is difficult to compare Obama’s achievements in office with the vast economic reforms created during the FDR era.

However one analyzes the impact of Roosevelt or Obama, it is clear that the Great Depression and the New Deal are vitally relevant to those grappling with today’s economic crisis. As a 10th-grade U.S. history teacher at Madison High School in Portland, Oregon, I knew that studying the 1930s would be especially pertinent to my diverse, largely poor and working-class students, whose families are still living with the effects of the 2007-08 meltdown. My goal was to get students to see the similarities and pinpoint differences between the two crises and the two presidents. I hoped they would question why Roosevelt’s presidency produced so many more and so much deeper structural reforms than Obama’s. By the end of Roosevelt’s first two terms in office, nonagricultural private-sector workers had the right to organize unions and the National Labor Relations Board was created to enforce that right. The unemployed had access to a new, permanent system of unemployment insurance, and the elderly could rely on social security. Millions of people were put back to work through federal jobs programs.

Did the differences indicate that FDR was a better politician? Was he more left-leaning than Obama and today’s Democratic Party? Or was the difference the result of massive pressure on Roosevelt from below—the strength of organized labor and other mass movements of the 1930s? Were the New Deal reforms an instance when the government genuinely intervened on the side of poor and working people or, as historian Howard Zinn wrote, were they aimed at “giving enough help to the lower classes to keep them from turning a rebellion into a real revolution?” Exploring these questions requires delving into a people’s history of the Great Depression and the New Deal—one too often overlooked in the history textbooks.

Beyond the Stock Market Crash

I knew the first step was helping my students understand what caused the Great Depression, and I wanted to do it in a way that would help them understand economic crises today. That’s the subject of this article (Part II will describe how I taught the New Deal itself).

Previously, when I taught the Great Depression, I was dissatisfied with the curriculum I used, especially the textbook explanations of the causes of the economic crisis, which focus almost exclusively on the 1929 stock market crash. For example, the “Causes of the Great Depression” section of Portland’s adopted textbook History Alive! Pursuing American Ideals devotes half-page sections to the crises of overproduction and underconsumption, but the authors spend three full pages explaining the stock market crash.

The problem with focusing narrowly on the crash is that it locates the explanation for the crisis in the financial sector, implying that the financial sector is not itself intimately linked to the real, productive economy. This prevents students from understanding the root causes not only of the Great Depression, but any economic crisis. It removes the role of ordinary people in the economy by focusing exclusively on a small and privileged group: investors with enough cash to play the stock market. As economist Richard Wolff explains: “Today’s global economic meltdown is no mere financial crisis . . . [but rather] a systemic crisis rooted in the conflicted relation between employers and employees across all capitalist enterprises in the United States.” The problem, he insists, “engulfs households, enterprises, and the government. It is a crisis of capitalism and not merely of finance” (2009).

To help students understand this concept, I created a simulation, the Widget Boom Game, which draws inspiration from Rethinking Schools editor Bill Bigelow’s Thingamabob Game simulating the relationship of capitalist production to the climate crisis (see Resources). I wanted students to understand that a capitalist economy, in which businesses compete with each other in hopes of capturing a larger and larger share of their market’s profits, is inherently prone to crisis.

Originally I tried to create a simulation that included both overproduction—when there are too many goods on the market to be sold for a profit—and underconsumption—when workers make so little they can’t buy the products. Unfortunately, the math got too complicated, so I decided to center the simulation on overproduction and deal with underconsumption in the discussion afterward.

I thought that having a strong grasp of overproduction would help students understand what caused and continues to cause economic crises under capitalism, and also help them understand the early New Deal. For example, students—like much of the U.S. population during the Great Depression—have a hard time understanding the logic behind the Agricultural Adjustment Act (AAA) of 1933. The AAA paid farmers to not plant on part of their land and to destroy crops and livestock. As my student Alberto declared on learning this, “It’s crazy to pay farmers to destroy food while people all around the country are going hungry.” But, of course, it isn’t crazy if you are looking at the problem through the logic of the free market: Prices for agricultural goods were too low to sell at a profit (even though there were millions of people who needed those goods). So, in order to raise the prices of agricultural goods and make farming profitable, the government reduced the supply.

Similarly, on the advice of business leaders, Congress passed the National Industrial Recovery Act, which suspended antitrust laws put in place to prevent monopolies, so businesses in a specific industry could come together in trade associations and write “codes of fair competition.” From the perspective of a worker or someone living in poverty, this proposal was a disaster—it allowed businesses to get together to keep wages low and prices high. But from the standpoint of a corporate executive, it made perfect sense. If businesses could get together and agree on how much to produce, they could balance out the market to their mutual advantage.

The Widget Boom Game

After completing some background lessons on the labor movement and early struggles between workers and employers from The Power in Our Hands (see Resources), we were ready to play the Widget Boom Game. I separated students into seven small groups of “widget” producers and generated some initial enthusiasm by taunting students with the chocolate bars they would receive if they won. Then I encouraged each group to come up with an original name for their company. I wrote the company names—Widgets World Wide, Chocolate for Life, and so on—on the Widget Boom Game Scoring Guide, and then passed out the Widget Boom Game Role Sheet, which we read together. As the role sheet explains, during the game the various companies compete against each other to capture more and more of the widget market:

Your goal, of course, is to end up with a mountain of money. There are several ways to increase your profits. One way to increase profits is by reducing your labor costs. If you pay your workers less, you have more money left over as profit. You can also make your workers work faster or for longer hours without raising their pay. The problem is that you’ve already done this. . . . Right now there isn’t much profit to be made by reducing your labor costs.

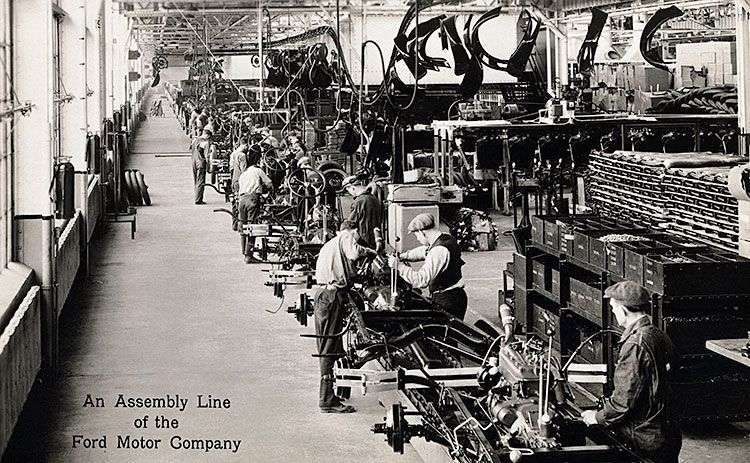

So the best way to increase your profits is to sell more widgets by increasing productivity—increasing the number of widgets each worker can produce. There are new machines that allow workers to produce more widgets in the same amount of time. In fact, newer and better machines are being invented all the time. With each new piece of productive machinery you buy, your business can produce more and more widgets.

Every member of the group with the most profits at the end of five rounds would receive a candy bar. However, as the role sheet explains, there’s a problem:

There are only so many people who need widgets. If there are too many widgets on the market, there won’t be enough people who want or can afford to buy them. If this happens, there is a crisis of overproduction in the widget market. No one knows exactly how many widgets is too many, but market analysts suspect it to be somewhere between 1,000,000 and 3,000,000 widgets. If the total production of widgets for all rounds goes above this trigger number, it will start an economic depression. All the widget companies will go out of business and no one will receive any candy.

At this point, I made a show of secretly writing the trigger number for overproduction on a piece of paper, folded it up, and taped it to the chalkboard to reveal at the end of the game.

For each of the five rounds, every group filled out a Widget Production Handout, which helped them calculate how many widgets they wanted to produce and how much profit they would make that round.

During the first round, I circulated around the room, helping groups that didn’t quite understand what to do. I encouraged groups to keep their production values to multiples of a hundred to keep the math simple. Once it was clear all the groups knew how to play the game, I began encouraging them to produce as much as possible, acting like an infomercial for widget producers: “Everyone wants a widget! They can’t get enough of them! They’re begging you to make more!”

As each group finished their Widget Production Handout, I collected it. After collecting all the handouts, I focused the class’s attention on the Widget Boom Game Scoring Guide at the front of the room. The teams watched carefully as I wrote down how many widgets each group had produced—and how much closer they were to producing past the limit of the market.

After the first round, teams had the option of buying new machines that exponentially increased their productive capacity. This, of course, meant more profits for their group, but also threatened that widget production would be extended beyond the limits of the market. If they were buying a new machine, they incorporated their new productive capacity into their math as they filled out the Widget Production Handout.

At the end of the fifth round, I opened up the folded paper and revealed the trigger number. There was a collective “Awwww!” as students realized that no one would get chocolate. Without fail, the competition among teams for chocolate led them well above the trigger number. Even when students produced far beyond the 3,000,000 mark, they eagerly waited for the reveal, hoping that somehow all those “market analysts” were wrong.

“Can we still get some chocolate, Mr. Sanchez?” Juan desperately asked. “Sorry, Juan, that’s not how capitalism works,” I replied. If I was worried that the absence of a chocolate payday would sour my relationships with students, Jackie, who was typically more engaged with her latest text message than the topic we were studying in history class, quelled my fears as she left the room. “Can we do this every day? I can’t believe I had so much fun in history class.” I laughed and took her comment as a compliment, trying hard not to see it as an admission that the entire first quarter didn’t measure up.

The next class, the students stepped out of their roles as widget industry corporate executives to discuss the simulation. I started by projecting an infographic with 24 white houses and one red stick figure. Text at the top of the graphic explained that “one in seven houses in the United States is empty. One in 402 people in the United States are homeless.” To hammer this point home, text below the graphic stated: “Twenty-four empty houses are available for each homeless person in the United States.”

“That’s awful!” Amelie cried out. “Why don’t we just give those homes to the homeless people?”

“Great question, Amelie. The reason ‘we’ don’t just give homeless people homes under our current economic system is because the companies that made those homes wouldn’t get any profit if they were given away.”

“Yeah, you can’t just give people free stuff,” Michael interjected.

“But that’s horrible,” Amelie insisted.

“Absolutely,” I said. “I started with this graphic because this is a crisis of overproduction—just like our simulation the other day. Under the economic system of capitalism, a crisis of overproduction doesn’t mean that millions of people don’t need or want the ‘overproduced’ goods. It just means that businesses can’t sell those goods at a profit. This will be important to keep in mind when we look at the proposals for how to fix the economy—in particular the agricultural economy—during the Great Depression.”

Then I asked who or what they thought was responsible for the crisis of overproduction that we triggered in class. “Ali!” Lateesha blurted out, referring to a particularly animated student whose motto during the simulation had been “Go big or go home!”

After the laughter died down, I tried to get them to dig a little deeper. “Beyond blaming individuals or particular groups, think about why no one stood up and said: ‘This is crazy. We’re all going to lose. Let’s cooperate on this and not make as many widgets.’ Is there something hidden going on here? What about the rules of the game itself? How were the rules responsible for the crash?”

“It wasn’t particularly our fault,” said King, a member of Ali’s group.

“Yes, it was!” Lateesha insisted. “The whole goal was to get the most money. So some people thought ‘we have to get the most money’ and were too greedy. I’ll admit it—I was thinking that, too.”

Michael added: “No one wanted to cooperate because who cares about the other companies; it’s all about you. I want the chocolate so I’m going to produce as much as I can.”

“It was because of competition!” Alberto confirmed.

“Yeah, you were really encouraging us to be competitive, Mr. Sanchez, because you didn’t want to give away any of your chocolate,” Leo remarked.

“Well, I do love chocolate, but if I wasn’t encouraging you, do you think you would have been able to avoid crashing the economy?”

“No,” Marilyn said. “Because you’re still in competition with other companies. You’re trying to produce as much as you can.”

“That’s right. Because you’re all trying to capture as much of the widget market as possible, you end up producing too much. Now, would it be possible to have a different outcome? One where you don’t crash the economy?”

“Yeah. You just need to limit the widget production,” King answered.

“What would you have needed to do to limit the widget production?”

“We could have all joined together and made one big company.” Maria responded.

“Absolutely. You could have created a monopoly, where one company has all or most of the control over the market. That way you could make sure you never produced too many widgets. But let’s say there was a law against monopolies. What other ways could you have prevented the crash?”

“Communicate? Cooperate instead of fighting each other?”

“Yes. If you all were able to get together and decide on how much should be produced, you might be able to avoid producing too much without merging into one big company,” I replied. “But how would you make sure that no one produced too much? Let’s think about the real world. If there was too much production in one sector of the economy, who would have the power to tell the businesses in that sector that they have to cooperate and produce less?”

“The government,” answered Leo.

“By doing what? What can the government do?”

“They could pass a law.”

“Exactly. They could regulate the economy, meaning they would put regulations or restrictions on what business could and couldn’t do.

“So, to sum up, we’ve got three possible scenarios for how to prevent the economy from crashing: 1. You could all become one big business—a monopoly; 2. You could cooperate to try to prevent each other from producing too much; or 3. There could be government regulation—laws that let the government limit production.

“These options are important to remember because, during the Great Depression, they were all ideas that various people and groups suggested for how to fix the economy. The two main ideas from the business community were: Let’s bring together all the businesses in an industry to cooperate in trade associations, and let’s get rid of antitrust laws that prevent monopolies. At the same time, other people were saying: ‘No, we should regulate business; let’s put laws in place saying what they can and can’t do.’

“The Communist Party, Socialist Party, and other leftists went even further. They said that we needed a fourth option: The problem, they said, is the system of capitalism itself. As long as businesses are competing against each other to make a profit, there will always be economic crises. Those organizations thought that workers should own the businesses, and instead of producing for profit they should produce things based on what humans need. So they would have wanted to make sure that all those homeless people got to live in the empty houses.”

At this point in the discussion, the limits of the simulation became obvious. Although the Widget Boom Game was useful in helping students’ grapple with a key concept like overproduction, the game’s lessons were inherently limited because all students played the role of capitalists. This shaped their immediate perspectives on how to “fix” the crisis they caused, and reinforced what is already the dominant perspective of the media and their textbooks. Almost universally the go-to solution that surfaced in the postgame discussion—or occasionally during the game—was to group businesses together and create a monopoly. I was glad that students had experienced the lessons from The Power in Our Hands that put them in the roles of workers. Recalling those experiences helped them understand the limits of the simulation.

I asked them: “I want you to think about what effects these different proposals would have on workers. For example, think about how a monopoly would affect workers’ ability to organize. Would it be easier for workers to organize a union at McDonald’s or at Little Big Burger (a local burger chain)?”

“Little Big Burger,” Desmond responded. “Because McDonald’s is so big they don’t care if workers organize in one store. You would have to organize all over the country.”

“Right. The bigger the company, the more power they have over their workers. So if companies are allowed to merge into a monopoly or get together in trade associations, what is going to happen to their workers’ working conditions?”

“They’re going to be paid less.”

“And they’re going to have to work longer hours.”

I nodded agreement. “Now let’s go back to the beginning of the game, when I said you couldn’t make any profit from reducing your labor costs because you were already making your workers work faster and longer for little pay. Imagine for a second if every industry paid their workers this badly—the bare minimum they needed to survive. How might this affect the economy?”

“Workers couldn’t buy anything because they don’t have any money,” said Desmond.

“Exactly! And that is called a crisis of underconsumption—the flip side of a crisis of overproduction. These two concepts are important because, depending on which one you emphasized, you had a different solution to the Great Depression.”

After this comment some students were losing focus, so I assured them I only had one last question—even though I really had two. “What if workers are being paid less than they need to get by? What options do they have? If you can’t afford something you need now, like food for your children or rent money, what could you do?”

“Put it on your credit card,” said Jackie confidently.

“Right! You could go into debt to buy the stuff you need. And let’s say you’re a business at the start of the game and you want to buy the biggest machine possible but you don’t have enough money, what could you do?”

“Get a loan!” said Pratima.

“Exactly. And this is how the banks get involved in the economy. Banks want individuals and businesses to borrow money, because then they get interest on the loans, and that’s how the banks make a profit. Loans and credit help to prolong the boom, but they ultimately make for a bigger crash when the crisis hits because they encourage businesses to stretch their capacity way beyond the trigger number in the market, and they encourage consumers to stretch their spending way beyond what they can afford. So banks, credit, and loans exacerbate the crisis. They make the crash worse.”

I wondered here if I had been drawing too many conclusions for students, but I wanted to make sure that they understood the implications. Students were highly engaged in the simulation, but the lessons are ambiguous unless clearly drawn out through discussion. In the future, I would like to find ways for them to struggle more with the implications themselves.

After the discussion, we read the excerpt from History Alive! on “Causes of the Great Depression.” Before reading, we discussed what stocks were and how they fit into what we had just discussed. I tried to emphasize that, like loans and credit, stocks are connected to the real economy. So, although the focus of the textbook is on the stock market crash, the stock market crashed because there was something wrong in the real economy. I encouraged them to focus on the small sections on overproduction and underconsumption. For homework, I asked them to write a paragraph answering the question: What caused the Great Depression?

After reading their paragraphs, I wished I had chosen an alternative reading. Despite my emphasis on the real economy, about a quarter of my students still blamed the Great Depression on the stock market crash. Apparently, even an experiential simulation could not trump the authority of the textbook. Many students, on the other hand, definitely got it. Amy’s paragraph was one of the clearest:

The Great Depression was caused by overproduction and underconsumption. Companies produced too many products. Because workers were paid so little, they didn’t have enough money to buy the products being made. For a while, people borrowed money from the banks so they could still buy the products they needed, but they had no way to pay back their debt. Stockbrokers bet on businesses, but when those businesses started to fail because of overproduction, the stock market crashed. Banks ended up closing after giving out their customers’ savings to stockbrokers, who didn’t have money to pay banks back after the crash.

Now we were ready to talk about what actually happened during the New Deal.

Resources

- Detailed instructions and materials for the Widget Boom Game

- Bigelow, Bill. 2014. “The Thingamabob Game.” A People’s Curriculum for the Earth. Rethinking Schools.

- Bigelow, Bill and Norm Diamond. 1988. The Power in Our Hands: A Curriculum on the History of Work and Workers in the United States. Monthly Review Press.

- Wolff, Richard. Sept. 7, 2009. “Capitalism Hits the Fan.” Harpers.

- Zinn, Howard. 2003. A People’s History of the United States: 1492-Present. HarperCollins.